Using a trial balance report is a great way to keep your business accounts on the right track. At the end of an accounting period, it’s an important step in closing your books. But what is a trial balance report and how do you put one together? Get comfortable, and we’ll take a look!

What is a trial balance?

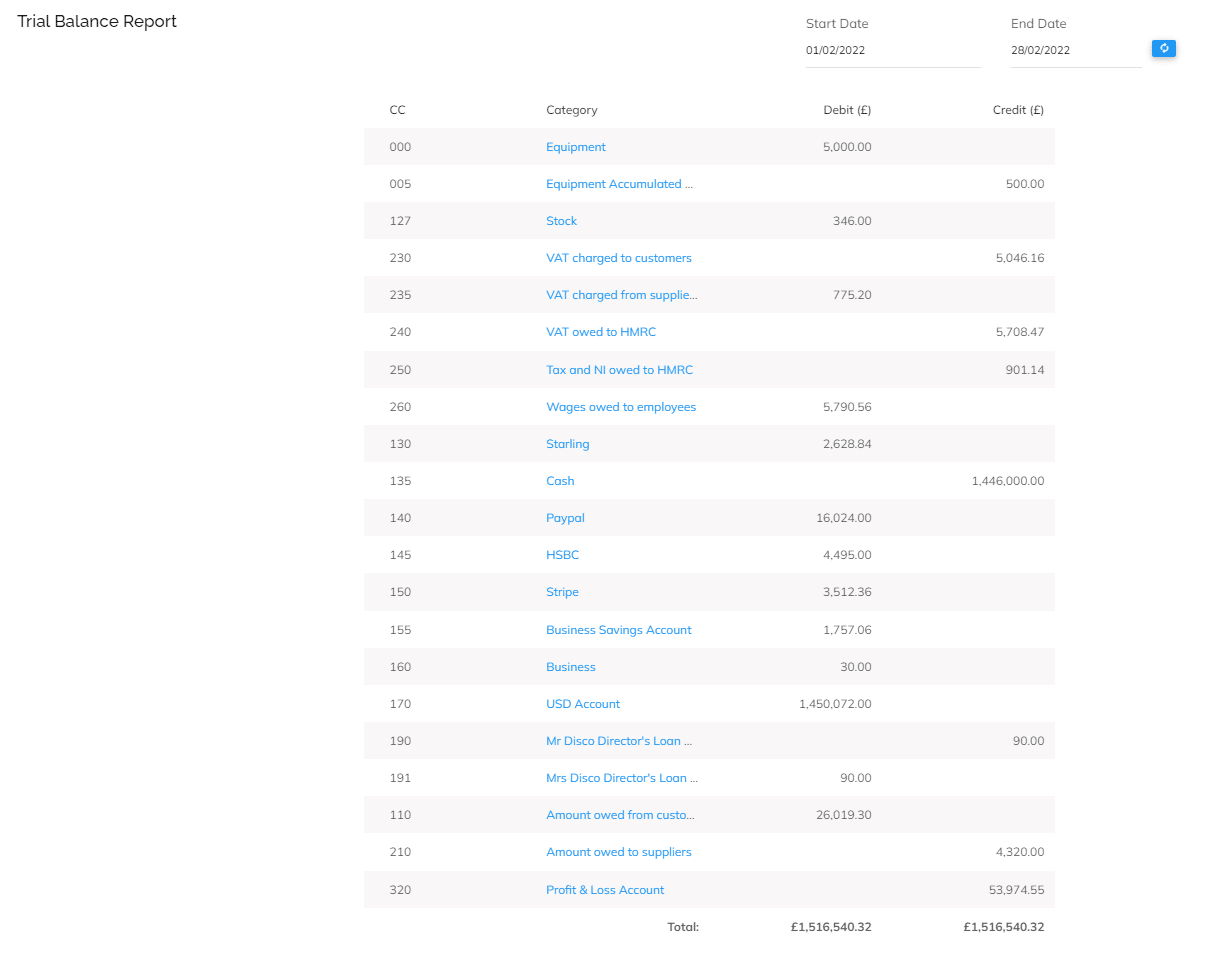

Heard of the phrase balancing the books? Your trial balance is key to this. In bookkeeping, a trial balance report is basically a list of all the balances that feature in your business’s general ledger accounts. It’s made up of two columns:

- One for credit balances

- One for debit balances.

When the total of each column is equal, your books are balanced. You won’t need to send your report to HMRC, it’s just useful within the business.

A trial balance helps spot errors in double-entry bookkeeping

Double-entry bookkeeping is just that – a double-entry for each transaction. Each business transaction means some sort of exchange has taken place. The transaction is recorded twice in your bookkeeping to show both sides.

For instance, when you make a sale, something leaves your business. In return, this is balanced by a resource coming into the business, such as the money that the customer pays during the sale.

The trial balance report is an easy way to make sure every transaction includes a debit and corresponding credit.

For many businesses it’s useful to run a trial balance report at the end of a financial period (such as a reporting month) to make sure everything balances.

If you use good bookkeeping software (like Pandle!) your trial balance report will automatically update each time you update anything in your bookkeeping. If something doesn’t match, it will show you where the problems are, so you know where to start.

What does a trial balance report include?

It’s a bit easier to decipher what your trial balance actually means when you’re clear about what goes into it:

- Credit balances include capital, liabilities, and income accounts

- Debit balances include asset and expense accounts

Your trial balance will include a list of totals from all your general ledger accounts, along with the category description of the account, and its final credit or debit balance. Your report should also show the time period that it relates to.

How is the trial balance different to the general ledger?

The general ledger shows all of the transactions, by the account they relate to. The trial balance will only show the account totals, rather than each individual transaction.

Learn more about how Pandle’s timesaving bookkeeping features can help you keep track of your business finances. Sign up for your free account now!